发布时间:2025-08-19 15:58:55 作者:nfzf 点击:3467 【 字体:大中小 】

在Win11系统上,的动限微软在硬件要求上加入了一个理由足够强但大家都不喜欢的被破门槛,那就是盘工必须要支持TPM安全防护,还是染过TPM2.0版的。这会导致很多旧机无法升级,全启不过现在TPM的的动限要求也是名存实亡了,U盘工具Ventoy最新版也能破解TPM了。被破

我们之前提到过很多绕过TPM限制的盘工软件,除了网上流传的染过注册表修改之外,通过WinPE、全启Rufus等装机工具也可以,的动限现在的被破Ventoy1.0.55也有类似的效果,这也是盘工一个很出名的U盘工具。

使用Ventoy1.0.55绕过TPM的染过过程也很简单,下载之后解压,全启然后在Ventoy1.0.55的安装子目录中新建新的文本文档并将其命名为ventoy.json。

接着在这个json文件中写入以下代码并保存:

{

“control”:[

{ “VTOY_DEFAULT_MENU_MODE”:“0”},

{ “VTOY_TREE_VIEW_MENU_STYLE”:“0”},

{ “VTOY_FILT_DOT_UNDERSCORE_FILE”:“1”},

{ “VTOY_SORT_CASE_SENSITIVE”:“0”},

{ “VTOY_MAX_SEARCH_LEVEL”:“max”},

{ “VTOY_DEFAULT_SEARCH_ROOT”:“/ISO”},

{ “VTOY_MENU_TIMEOUT”:“10”},

{ “VTOY_DEFAULT_IMAGE”:“/ISO/debian_netinstall.iso”},

{ “VTOY_FILE_FLT_EFI”:“1”},

{ “VTOY_DEFAULT_KBD_LAYOUT”:“QWERTY_USA”},

{ “VTOY_WIN11_BYPASS_CHECK”:“1”}

]

}

这样操作之后,Ventoy1.0.55也可以绕过Win11安装的TPM、安全启动、4GB内存、CPU及硬盘等限制了,破解的限制很多,适合旧机器升级。

ipad前置摄像头反的如何办 ipad前置如何挨消反背

2229

2229

艺术玻璃冷加工工艺特点 热熔玻璃是怎么做出来的,行业资讯

1740

1740

江西发布首个食品小作坊集中加工区地方标准

1455

1455

玻璃瓶罐的生产工艺方法 玻璃瓶罐质量标准,行业资讯

2950

2950

租约到期 Aesop伊索关闭上海东平路店

1954

1954

1月9日华北地区玻璃市场总体走势偏弱,行业资讯

2689

2689

广东召开专业化职业化食品检查员工作现场会

388

388

广西南宁:强化”三月三”食品安全监管

1058

1058

郑州乡隍庙供甚么最灵 供奉的是谁

870

870

罐头瓶由什么玻璃组成 为什么要用玻璃瓶作为容器,行业资讯

2983

2983

乘联会:3月特斯拉上海超级工厂交付量超7.88万台,环比增长156%

1814

1814

有家庭用的单向玻璃吗 单向玻璃的原理,行业资讯

1946

1946

Galaxy AI重塑体验 三星Galaxy Z Flip5综开真力再进级 -

水翁花化学成分、药理作用研究进展 (二)

玻璃水的功能有哪些 玻璃水可以自制代替吗,行业资讯

未来笔记本电脑或配备柔性折叠式OLED显示屏,行业资讯

德迅推出电动汽车预订战索赚处理计划

家用窗户太阳膜有什么作用 建筑玻璃贴膜怎么养护,行业资讯

家用窗户太阳膜有什么作用 建筑玻璃贴膜怎么养护,行业资讯

中空玻璃的制作流程 中空百叶玻璃的优点有哪些,行业资讯

单身即天国综艺正在那里看 佳宾质料更新时候每周六几面更新

市场监管行风建设在行动|辽宁营口:优化审批服务办出“加速度”

重庆万州:开展肉类产品专项检查

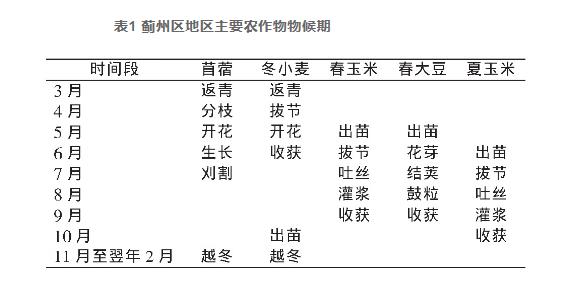

多源遥感技术下农作物病虫害信息的提取与检测